The specific credit score requirements for buying a house in Mexico can vary depending on the financial institution and the type of loan you're applying for. However, generally, lenders in Mexico typically consider various factors such as your credit history, your income, debt-to-income ratio, and other financial considerations, in addition to the credit score.

That said, having a good credit score can certainly improve your chances of getting approved for a mortgage and obtaining favorable loan terms. While there isn't a specific minimum credit score universally required to buy a house in Mexico, having a credit score from 680 (FICO for Americans) is generally considered favorable for securing a mortgage with decent terms. However, this can vary depending on the lender and the specific circumstances of your application.

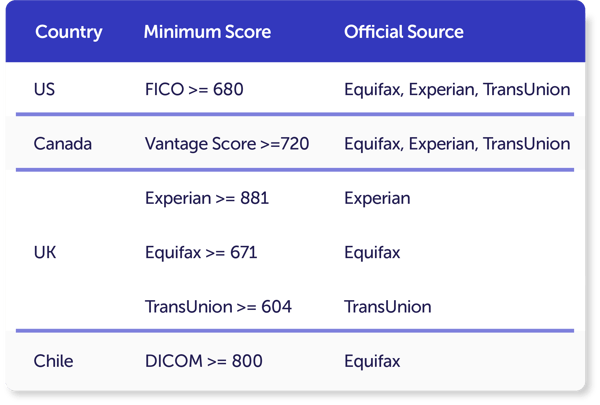

In Yave, the first 100% digital mortgage in Mexico, we request the credit score as follows:

It is important that the Credit Bureau report includes the following:

- Applicant's full name (matching the one on the application).

- Applicant's identifier (SNN).

- Account balances (balance, monthly payments and history).

If your Credit Bureau is not on the above list, don't worry, Yave accepts most nationalities. Just contact us at: rodrigo.yeo@yave.mx

Is immigration status important?

For Yave, it is important to offer flexible policies so that more foreigners can fulfill the dream of owning a home in Mexico. It is not necessary to have residency in the country, but it is important to have legal status (FM3, FM2, and FMM). The type of purchase you can make in Mexico will depend on your immigration status. For example:

- Permanent residency (FM3): You can buy in restricted* and non-restricted areas without the need for a representative in Mexico.

- Temporary residency (FM2): You can buy in non-restricted areas as long as you have a representative in Mexico.

- No residency (FMM): You can buy in non-restricted areas as long as you have a representative in Mexico.

Advantages of Yave's mortgage loan for foreigners

1. Financing of up to 85% of the property value. Only a 15% down payment is required.

2. Multiple co-borrowers. The client's co-borrowers can be friends, family members, or partners (without the need to be married). From 1 to 5 co-borrowers in total.

3. 100% online process (except at the moment of buying the home). Approval takes 24 to 72 hours, while the processing time ranges from 1.5 to 2 months.

4. Personalized service. Yave provides personalized assistance in Spanish and English. Support is available 24/7.

5. Loan in Mexican pesos (historically, the USD appreciates its value vs the Mexican peso).

6. Fix interest rate, Up to 20 year term.

7. No prepayment penalty and no title insurance required.

Finance your dream home in Mexico. Yave provides fast, easy and transparent mortgages for non-mexican residents.

* Corresponds to a strip of 100 km along the borders and 50 km wide along the coasts.

Dejar comentario